1st time home buyer bad credit no down payment

Low rate auto loans auto refinancing mortgage loans home equity loans and lines of credit and more. No one expects you to be an expert on the home buying process especially when you.

First Time Home Buyer California Gives 0 Down Payment Loan Los Angeles Times

How to buy a house with 0 down.

. Look into first-time home buyer programs. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The programs minimum eligibility standards include. Minimum Conventional Loan Down Payment. FHA loans are a good option for first-time buyers with poor credit or anyone who doesnt have 20 to put toward a down payment.

7098 Annual interest rate. The LIFT Act can be combined with other first-time buyer programs including the 15000 First-Time Home Buyer Tax Credit and the 25000 Downpayment Toward Equity Act. A first-time buyer is expected to put down a deposit of at least 10 of a propertys purchase price.

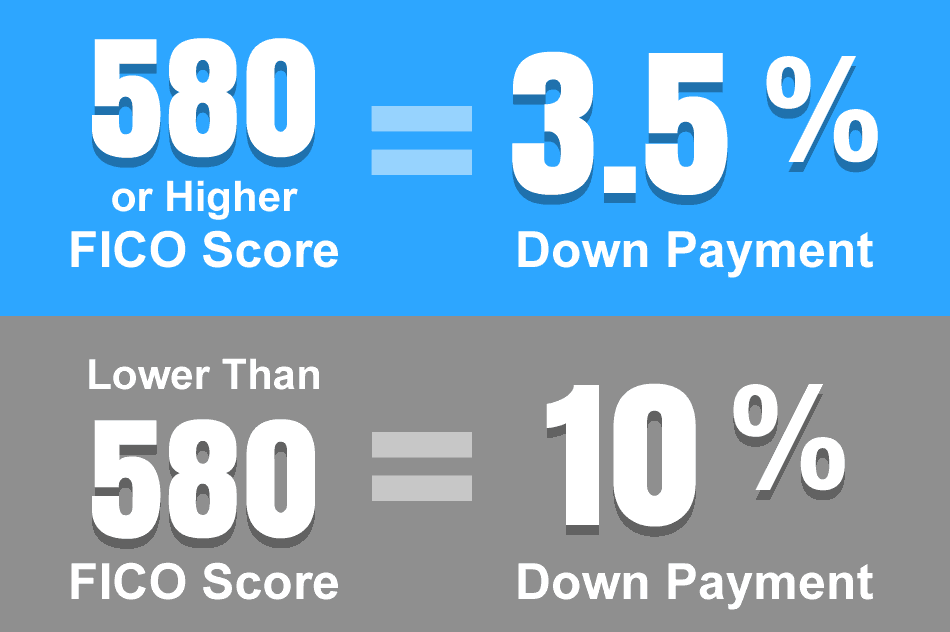

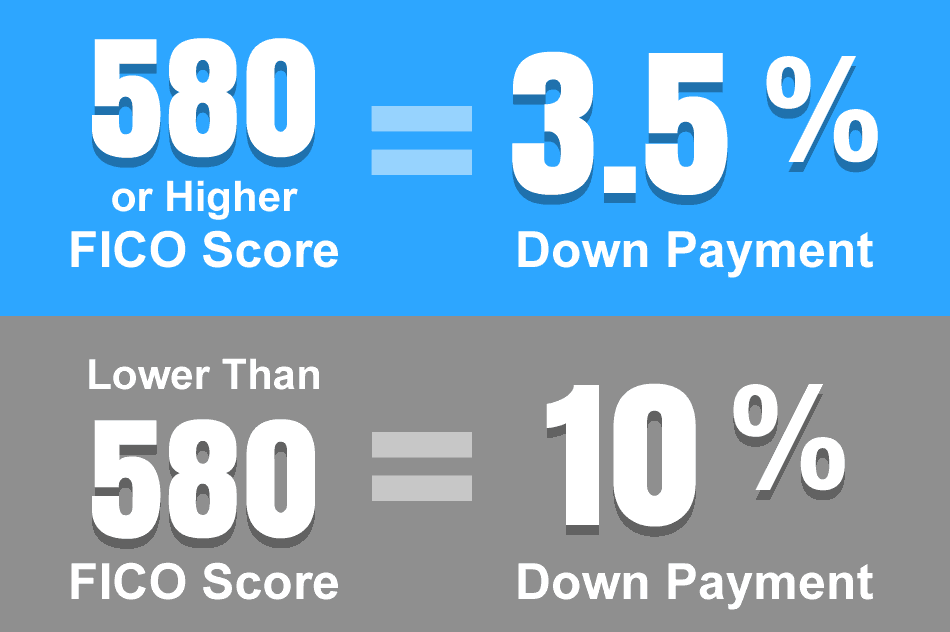

FHA loan Insured by the Federal Housing Administration FHA loans allow borrowers to buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score as low. The bill for first-time buyers is modeled on the 8000 First-Time Home Buyer Tax Credit from the 2008 Housing and Economic Recovery Act. Louis Missouri Gross annual income.

Must meet income and purchase price limitations for the area. Federal Housing Administration FHA Loans. Buyers have the.

2902 Estimated closing costs. But even a small down payment can be challenging to save. Down Payment Assistance for Homeowners.

Must use an FHA-backed. Branches in Chicago Rockford Evanston. This increase means first-time home buyers now get up to 1500 back at tax time a 750 increase.

With no hard credit check and lock your rate at. The first-time home buyer tax credit is automatically for eligible home buyers. Nova Scotias Down Payment Assistance Program provides an interest-free loan of up to 5 of the purchase price of a home to cover the minimum down payment.

No debt with middle-of-the-road credit. Minimum credit score of 580 although some lenders might allow a score as low as 500 with 10 down. Secondly the First-Time Home Buyers Tax Credit is being doubled from 5000 to 10000.

Many first-time homebuyer programs grants and down payment assistance programs are available to help you secure the financing you need to purchase your first home. Low down payment first-time home buyer loans. Find all available Minnesota first time home buyer programs grant money and down payment assistance.

First-time home buyer First-time home buyer guide. How to buy a house with bad credit. But CarDestination doesnt believe in your credit history.

Traditional lenders may consider bad credit car buyers risky. Conventional home loan. The First-Time Home Buyer Incentive that allows first-time homebuyers to partner with the government when buying a home is being extended until March 31.

But no matter what your down payment is make sure your housing payments are no more than 25 of your monthly take-home pay on. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. How Much Are Buyer Closing Costs.

Buying your first home is a huge commitment and a time-consuming process but it can be easier with preparation. The 15000 First-Time Home Buyer Tax Credit has precedent which makes it the most likely first-time buyer program to pass Congress. Bad Credit is OK.

Being a first-time home buyer can be exciting and daunting in equal measure especially if you have to learn about mortgages too. 237 Homeowners association fee. 2022 Minnesota first time home buyer programs.

Federally the First-Time Home Buyer Incentive helps provide interest-free financing through a shared equity mortgage of up to 10 the purchase price of a newly constructed home or 5. If your current income is stable and you have lesser debt you will be approved in no time. 7 Loan options for 2022.

Bank of Americas Community Homeownership Commitment provides a low down payment mortgage for modest-income and first-time homebuyers. If 20 is still out of reach for you as a first-time home buyer a smaller down payment of 510 is okay too. Bad Credit Home Loans.

Adjunct membership is for researchers employed by other institutions who collaborate with IDM Members to the extent that some of their own staff andor postgraduate students may work within the IDM. For 3-year terms which are renewable. You should have a 20 down payment and should keep your housing costs below 25 of your income.

Serving northern Illinois since 1944. The first-time homebuyer tax credit is up to 15000 or 10 of the homes value whichever was less. 25000 Amount of money.

Minimum credit score of 620. Login Register 651 789-5326 651 789-5326. Use a down payment calculator to decide a goal and then set up automatic.

Not everyone will qualify for a zero-down mortgage. Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment zero closing cost mortgages to help grow Read More Housing expert. Rental price 70 per night.

A car buyer can obtain guaranteed low rates on auto loan. This is good for first-time home buyers because FHA loans allow for a low down payment of just 35 which can help a household with good income but less-than-optimal savings move from renting. Learn how our Affordable Loan Solution mortgage with a down payment as low as 3 income limits apply might help make home buying more affordable.

Get 247 customer support help when you place a homework help service order with us. Must be a first-time home buyer. Credit cards for bad credit Cashback cards Rewards cards Use abroad cards Money transfer cards Loans.

For example a 3 down payment on a 300000 home is 9000.

First Time Home Buyer Programs By State Nerdwallet

What S The Best Loan For A First Time Home Buyer Nfcc National Foundation For Credit Counseling

How To Buy A House With 0 Down In 2022 First Time Buyer

12 First Time Home Buyer Mistakes And How To Avoid Them Nerdwallet

First Time Home Buyer Down Payment How Much Is Needed

First Time Home Buyers Are Once Again On The Rise And Younger Than Ever Many Still Aren First Time Home Buyers Real Estate Infographic Home Buying Checklist

First Time Home Buyer Down Payment Strategies Nerdwallet

First Time Homebuyer Grants And Programs Nextadvisor With Time

California First Time Home Buyer Programs Of 2021 Nerdwallet

How To Get A Bad Credit Home Loan Lendingtree

8 First Time Home Buyer Grants In 2022

How To Buy A House With 0 Down In 2022 First Time Buyer

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Loans For Bad Credit Bad Credit Mortgage No Credit Loans

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

Minimum Credit Scores For Fha Loans

Kentucky First Time Home Buyer Loan Programs First Time Home Buyers Kentucky Mortgage Loans

15 Florida First Time Home Buyer Grants Nerdwallet